Seeking the ideal solution for managing your small business’s payroll services?

Selecting the right payroll service can save valuable time and ensure your employees are paid accurately and on time.

A well-chosen service can help your business stay tax-compliant, saving potential legal headaches.

What are the Best Payroll Services for Small Businesses?

Small businesses need payroll services that offer functionality and affordability. After thorough research, here are our top picks.

1. Bambee

Bambee is a unique player in the HR and payroll space, providing full-service HR for small and medium-sized businesses. What sets Bambee apart is that it combines technology with human expertise to provide an accessible, affordable, full-service HR solution.

Regarding payroll, Bambee makes it easy to manage all aspects, from calculating taxes and processing payments to managing benefits and maintaining compliance.

Moreover, Bambee provides each client with a dedicated HR manager who can help with everything from crafting HR policies to advising on complex HR issues. These HR managers are certified professionals with an average of over 10 years of experience, so you can trust that you’re getting expert advice.

While it’s not the largest payroll provider on the market, Bambee provides a high level of personalized service that many larger providers can’t match. It also offers a flat-fee pricing model, which is simpler and more predictable than the per-employee pricing models used by many other providers.

Pros

- Personalized service

- Flat-fee pricing model

- Combines technology with human expertise

Cons

- Less established than some competitors

- May not have as many advanced features as some larger providers

2. OnPay

OnPay is one of the highly-rated online payroll services known for its simplicity and value. The company has designed its payroll platform to be as intuitive and user-friendly as possible, making it an excellent choice for small businesses that want a straightforward solution to process payroll.

In addition to its easy-to-use interface, OnPay is notable for its comprehensive feature set. The payroll software handles all aspects of small business payroll, from calculating taxes and processing payments to managing benefits and tracking time. It also includes HR tools to help small business owners manage employees more effectively.

Another thing that sets OnPay apart is its transparent pricing model. Unlike many payroll providers, which charge per feature or employee, OnPay offers all its features for one low monthly price, making it an excellent value.

Pros

- Easy to use

- Transparent pricing

- Good value for the price

Cons

- Fewer integrations than some competitors

- Not as many advanced HR features as some providers

3. ADP

ADP is a comprehensive payroll and HR solution suitable for businesses of all sizes, including small businesses that plan to scale. With a history spanning over 70 years and serving hundreds of thousands of businesses globally, ADP brings extensive industry knowledge and expertise to its offering.

ADP’s platform is designed to grow your business. It starts with basic payroll processing and payroll tax filing and extends to various HR-related services, including benefits management, retirement, insurance, and more. It also offers employee self-service and mobile app functionality, providing easy access for your workforce.

The platform integrates seamlessly with many popular business software solutions, allowing businesses to connect ADP with their existing systems. ADP’s customer service also has a solid reputation, providing support when needed.

Pros

- Extensive HR features

- Scalable to grow with your business

- Excellent customer service

Cons

- Pricing is not transparent.

- Some users report the interface is not as intuitive as competitors.

4. Paychex

Paychex Insurance Agency offers a robust suite of payroll, HR, and benefits management solutions suitable for businesses of all sizes. This provider is known for its high degree of customizability, allowing businesses to choose and pay for only the needed services.

From basic payroll processing and tax filing to more complex tasks like employee benefits administration and compliance assistance, Paychex covers a wide range of HR needs. The service also offers employee self-service and a mobile app, which helps increase accessibility and convenience for your workforce.

A standout feature of Paychex is its dedicated payroll specialist offering. Every client gets a specialist as their main point of contact, providing personalized support and expertise. This can be particularly helpful for small businesses needing a dedicated HR department.

Pros

- Highly customizable

- Wide range of services

- Personalized support

Cons

- Pricing is not transparent

- Some features may be overkill for very small businesses.

5. Gusto

Gusto is an intuitive, easy-to-use payroll service ideally suited for small to medium-sized businesses. Gusto’s simplicity and elegant design streamlines payroll, benefits, and HR into one convenient and efficient tool.

With Gusto, you can automate payroll and tax filing processes, significantly reducing administrative time. In addition, Gusto handles benefits administration and offers a range of HR tools and resources that small businesses will find beneficial.

What stands out about Gusto is its clear and straightforward pricing structure, including features such as unlimited payroll runs, employee self-service, and health benefits administration, even in its basic plan. Customer support is readily accessible, providing peace of mind for businesses venturing into payroll services for the first time.

Pros

- User-friendly interface

- Clear pricing structure

- Extensive features, even in the basic plan

Cons

- Limited advanced HR features

- May be too simple for larger businesses

6. Paycor

Paycor offers an all-in-one HR and payroll solution designed to streamline operations for small to medium-sized businesses. With Paycor, you can manage payroll, time and attendance, recruiting, and HR from a single platform.

Paycor’s standout feature is its customizability. The platform allows you to create custom workflows, fields, and reports to tailor the system to your needs. Also, it integrates with several third-party systems, enhancing its functionality and flexibility.

The service offers a mobile app, providing employees access to their data anytime, anywhere. Moreover, Paycor offers exceptional customer service, with each client assigned a dedicated support team to ensure a smooth and efficient experience.

Pros

- Comprehensive solution

- Highly customizable

- Excellent customer service

Cons

- Pricing is not transparent

- Can be overwhelming for very small businesses

7. Intuit QuickBooks

Intuit QuickBooks is a robust payroll service widely recognized for its tight integration with QuickBooks accounting software. It’s an excellent solution for small businesses already using QuickBooks for their accounting needs, providing an all-in-one solution for bookkeeping and payroll.

QuickBooks Payroll offers automatic payroll runs, tax filing, direct deposits, and an employee portal where employees can access their pay stubs, tax forms, and more. Its intuitive interface and seamless integration with QuickBooks make payroll processing a breeze.

One of QuickBooks Payroll’s unique features is the inclusion of a workforce portal that allows employees to access pay stubs, W-2s, and other information online. The platform also supports a range of benefits, including health insurance and retirement plans.

Pros

- Seamless integration with QuickBooks

- Easy to use

- Wide range of benefits

Cons

- Might be less suitable for non-QuickBooks users

- Advanced features require higher-tier plans

8. Rippling

Rippling is a comprehensive HR and payroll platform that stands out for its powerful automation capabilities. It’s an excellent choice for businesses seeking a streamlined and efficient way to manage payroll, HR, IT, and more in one centralized platform.

Rippling’s payroll software automates various payroll tasks, from tax filing to benefits deductions. Beyond payroll, Rippling also offers robust HR and IT management tools, providing a comprehensive solution for managing employees from onboarding to offboarding.

The platform supports flexible payment schedules, multiple pay rates, and garnishments, providing the flexibility to handle various payroll scenarios. With Rippling, businesses also access a dedicated customer support team to assist with queries or issues.

Pros

- Wide range of automation features

- Consolidates HR, IT, and payroll in one platform

- Dedicated customer support

Cons

- Pricing is not transparent

- Might be overwhelming for very small businesses

9. Deluxe

Deluxe is an established business service sector player, with a rich history spanning over a century. Its payroll service offering, Deluxe Payroll, is designed to simplify payroll management for small businesses while ensuring compliance with government regulations.

Deluxe Payroll provides various payroll processing features, including direct deposit, paper checks, detailed reports, and automatic tax filing. It also integrates seamlessly with popular accounting software, further streamlining your business operations.

One of the standout features of Deluxe Payroll is its dedicated support team that guides businesses through setup and beyond. This customer-centric approach and its extensive payroll features make Deluxe a worthy contender for small businesses seeking an easy-to-use, efficient payroll service.

Pros

- Extensive payroll processing capabilities

- Excellent customer service

- Easy-to-use interface

Cons

- Pricing information is not readily available.

- Lacks some advanced HR features

10. Square

Best known for its payment processing solutions, Square also offers a payroll service tailored for small businesses, particularly those in the retail and hospitality sectors. Square Payroll stands out for its seamless integration with Square’s suite of business services.

Square Payroll provides all the essential features a small business would need: automatic payroll runs, tax filings, direct deposits, and more. It’s also designed to handle salaried employees and contract workers, making it an excellent option for businesses with a mix of worker types.

One unique feature of Square Payroll is its integration with Square’s point-of-sale (POS) system, which can automatically import employees’ hours for payroll. This can save considerable time and reduce errors associated with manual data entry.

Pros

- Seamless integration with other Square services

- Good for a mix of worker types

- Automatic import of employees’ hours

Cons

- Limited advanced features

- Might not be suitable for non-retail businesses

11. Papaya Global

Papaya Global offers a revolutionary global payroll service suitable for small businesses with international operations. Papaya Global is the way to go if you’re seeking to simplify the complex task of managing international payroll.

Papaya Global’s platform provides a unified global payroll, payments, and HR services solution. Its standout feature is the ability to manage, track, and process international payroll operations in over 140 countries.

One of the unique aspects of Papaya Global is its data analytics capability. Businesses get comprehensive, real-time reports that give insights into payroll costs across different regions, aiding strategic decision-making.

Pros

- Ideal for international operations

- Comprehensive data analytics

- Simplifies global payroll management

Cons

- Might be overkill for domestic-only businesses

- Pricing is not transparent

12. Remote

Remote is another excellent solution for small businesses with a global workforce. The platform is designed to simplify international employment, providing a full suite of global payroll, tax, benefits, and compliance management services.

Remote’s payroll service simplifies global payroll by ensuring compliance with local labor laws and handling tax filings and benefits administration in various countries. It’s a true remote-first solution with features designed to support distributed teams.

One of Remote’s standout features is its commitment to providing a first-class employee experience. From localized contracts and benefits to seamless onboarding, Remote helps businesses attract and retain the best global talent.

Pros

- Streamlines international payroll and HR

- Ensures local compliance

- Focus on employee experience

Cons

- Pricing is not transparent

- Might not be suitable for domestic-only businesses

FAQs

Here are the most frequently asked questions about payroll services.

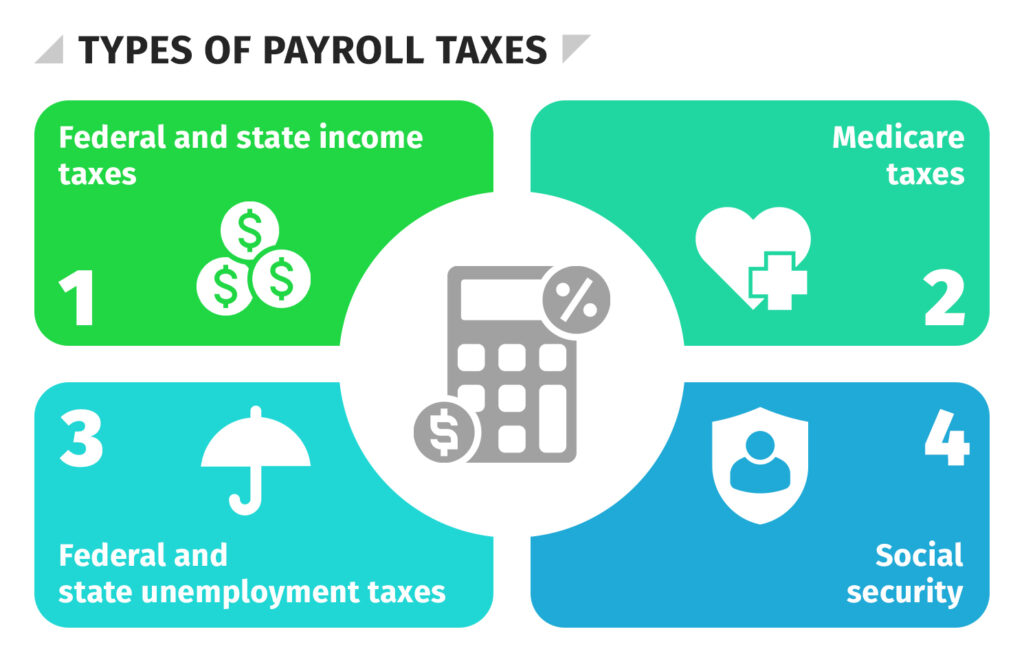

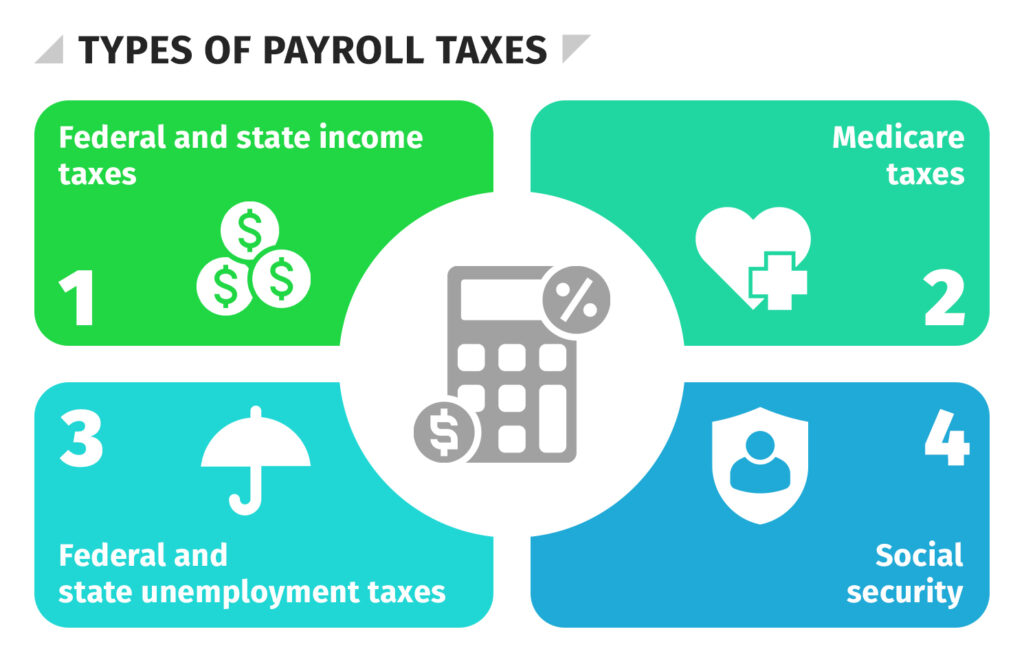

What are small business payroll services, and why are they important?

Small business payroll services are tools or professional services that help businesses efficiently manage their payroll operations. These services ensure that employees are paid accurately and on time while also handling tax calculations, deductions, and compliance. Using reliable small business payroll services can save time, reduce errors, and stay compliant with tax regulations.

How does small business payroll software simplify payroll processing?

Small business payroll software automates the small business payroll processing, making it easier to manage tasks like calculating wages, withholding taxes, and tracking employee hours. With just a few clicks, businesses can run payroll for their teams, saving valuable time and minimizing manual errors. Payroll software often comes with features like automatic updates for tax rates, employee self-service portals, and integration with accounting systems, streamlining the entire process.

How often can I run payroll with payroll services?

With most small business payroll services or software, you can run payroll as often as needed—weekly, biweekly, or monthly. Flexibility in payroll schedules allows you to cater to your business needs and employee preferences. Many services also offer automated first payroll processing, reducing the time required to manage recurring pay periods.

Can payroll services generate payroll reports?

Yes, most small business payroll software and payroll services generate comprehensive payroll reports. These reports provide insights into employee earnings, taxes, deductions, and company expenses. Payroll reports are essential for financial planning, tax payments, and maintaining accurate records for audits or compliance purposes.

Are small business payroll services cost-effective?

Small business payroll services are designed to be affordable while providing significant value to businesses. Automating tasks like payroll processing, tax filing, and generating payroll reports saves businesses time and reduces costly errors. This allows small businesses to focus on growth rather than spending time managing payroll manually.